Get in touch to see how we can help you optimize your digital strategy by understanding customer needs.

What are the points of contact here?

The established belief for many is that the pharmaceutical industry, bound by regulation, traditional mindset and inertia has long been operating as digital laggards.

Fast forward (a few years) to 2020. The global COVID-19 was seen to upend pharma’s reliance on in-person engagement and sales strategies. It is a myth to assume that the industry had not been investing in digital strategy long before that. Whether pharmaceutical companies had been executing these strategies well is another question altogether.

This article will look at digital marketing in pharma in more focus, specifically looking at insight Bryter has uncovered from thousands of interviews with physicians and specialists. Our findings show channel and content preferences, the use of social media, and which pharmaceutical companies are getting digital marketing right.

In the new COVID-19 landscape, marketeers require insight to inform and optimize digital marketing strategy. This requirement goes beyond measuring current HCP digital behaviors crucially, by exploring their current and future needs.

At the same time, digital is not intended to replace sales reps. Multichannel engagement is the most effective approach and, if used correctly, digital can keep reps connected with physicians more closely than ever. The challenge is in proving to physicians that digital can provide them with the same support that sales reps offer. Pharmaceutical companies must have in-depth knowledge of how they should be communicating and connecting with physicians.

Pharmaceutical marketing strategies have shifted considerably over recent years. Rapid developments in technology and digital communication, changes in healthcare professional attitudes to salesforce visits, the integration of digital technology into physicians’ daily lives, and drug patent expiry have all played a role.

For effective digital marketing, there is a clear need for pharmaceutical companies to provide information that is straightforward and easy for physicians to understand. Physicians value qualities such as interactivity, personalized content and information that they do not have to seek out. These experiences come hand-in-hand with sales rep face-to-face communication, but Covid-19 has led to a significant shift in preferences and behavior.

Some markets present a more significant challenge. In Belgium, there is a greater reliance on face-to-face meetings with sales reps, whereas in the UK and France physicians are generally more open to digital communications.

Bryter has been researching pharmaceutical marketing since its foundation in 2010. We focus on exploring HCP needs going way beyond the traditional approach in pharma-focused digital marketing research, which merely reviews channel recall and usage and/or satisfaction with information received.

To gain a better understanding of physician behavior in this digital landscape, this article draws on insight gleaned from numerous surveys conducted by Bryter with physicians over the past 2 years (i.e., since just prior to and through the global COVID-19 pandemic).

Before the pandemic began, Bryter asked physicians how they engage with pharmaceutical companies. Two-fifths of the physicians typically accessed pharmaceutical news and clinical trial updates digitally. Meetings with sales reps, however, took place in the traditional manner with three quarters citing face-to-face.

The pandemic, of course, has upended much of this. Face-to-face meetings have been replaced with digital, and it has been a challenge to create multichannel strategies to effectively reach HCPs. There has been a traditional belief that face-to-face and digital could not co-exist in the past, and there is still confusion on what kind of engagement is most valuable.

However, Bryter research also showed indications of a preference for mixed engagement even before the pandemic. When asked about preferences around engaging with pharmaceutical companies, HCPs overwhelmingly favored digital access or did not mind how they received that information. The shift towards digital preference is partly a result of an evolving physician demographic: almost 70% of HCPs are digital natives, spending more time online, and frequently accessing social media to gain information about pharmaceutical companies.

When making decisions, physicians spend twice as much time searching for information online than in print materials. Online conferences and presentations are also growing in clinician popularity due to lockdowns caused by the coronavirus, and previously a lack of time available to attend in person. As a result, mobile apps, such as Lexicomp, UpToDate and Halo, are becoming increasingly popular.

Despite this, a disparity exists between what physicians want and the communications they receive from pharma companies. Pharma continues to underutilize digital channels, as well as provide different content to what HCPs are most interested in.

Consequently, satisfaction with the content physicians receive remains low. The digital information provided needs to be tailored to individual audiences in terms of frequency, format, and actual content that informs and engages.

Moving forward, digital strategies are meant to strengthen customer relationships, in support of existing sales reps. Pharma companies that adapt their approach in a changing landscape will see that digital cannot replace sales representatives, nor does it need to. Multichannel engagement provides the opportunity to bridge the gap between the increasingly infrequent and sparse face-to-face visits with the convenience and flexibility of digital.

Creating a comprehensive digital marketing strategy in this new landscape is about developing a thorough understanding of engagement and channel preferences across demographics. Understanding where HCPs are, and what channels they prioritize is crucial for digital marketing in pharma to ensure that content is targeted correctly.

Bryter provides research that can produce the insight needed to develop a comprehensive and effective digital marketing and communication strategy.

The COVID-19 pandemic has forced the remote engagement model to the forefront. It is the future and here to stay as the need for increased digital interaction with sales reps continues and HCPs themselves become more tech-savvy.

In 2020, close to 70% of HCPs are ‘digital natives’, i.e., they studied medicine at a time when the Internet was already well-established. The youngest HCP segment spends about 40% more time online for professional purposes than their counterparts above the age of 60.3 Furthermore, two-thirds of doctors with mobile devices use them to source and share information more than ten times every working day.6

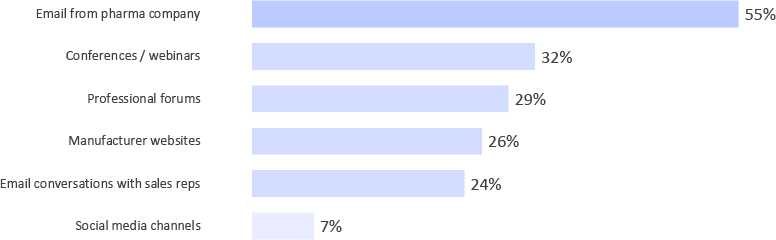

There is a clear gap between the preferred channels for accessing information and the frequency with which these channels are accessed. While HCPs might not want to be bombarded with information every day, clearly social media is a channel the pharma industry can further leverage to their advantage.

HCPs prefer to access social media most frequently to gain information about pharmaceutical companies, with a third likely to access it every week or every day. This is closely followed by instant messenger. In comparison, a fifth (significantly lower proportion) like to access their emails every week/day to receive information.

Since the start of the pandemic almost 39% of HCPs feel digital content from pharma companies has rarely been useful to them.

To better understand the needs of physicians, Bryter analyzed physicians’ current level of satisfaction with digital information provided by pharma companies, and the underlying factors that are driving their satisfaction.

Pharma companies are most valuable to physicians when these relationships fulfill a practical need that ultimately helps in supporting them in their practice and managing their patients.

Creating effective content strategies necessitates a need to dive deeper to understand preferences. Our research uncovered distinct preferences in the type of content that drives satisfaction across specialities, reflecting their different needs as a physician.

For example, cardiologists place greater value on content that actively supports them in managing their patients. Meanwhile, GPs, who must gather generalist knowledge across several disease areas, highly value pharmaceutical companies that provide them with information on a regular basis, helping them to stay up to date.

This highlights the need for pharma to tailor approaches to their individual audiences. Using insight, pharma companies can develop digital communication strategies that are tailored to specific HCP demographics.

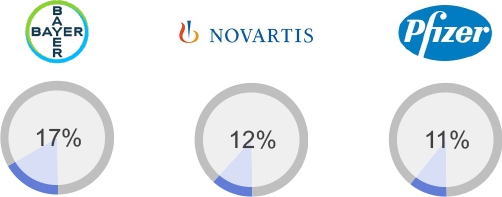

HCPs identified the following companies as delivering the best digital information

However, all three companies have room for improvement on the two main factors HCPs considered valuable when receiving communication from pharma - easily digestible (55%) and an immediate response to questions (50%).

Ensuring that digital content delivers on the key drivers of satisfaction identified for different physician types will help to maximize the effectiveness of digital communications in an area that continues to grow in importance with the longer-term impact of the COVID-19 pandemic.

Creating effective content that achieves optimum engagement and delivers the maximum value to the brand requires companies to first understand the needs of their audience, which content is needed and therefore most useful to its customers.

In order to help create such content, and to help understand the needs of the audience, Bryter evaluated ratings for specific attributes of digital information and overall satisfaction and uncovered the main four drivers to satisfaction for community oncologists.

Bryter uncovered each company’s performance on each of the main four drivers to satisfaction for community oncologists when looking at digital information about immune-oncology and novel cancer therapies:

The ability to tailor information for use with patients is by far the biggest driver of satisfaction for pharmaceutical digital information regarding IO and novel cancer therapies. Creating interactive and on-demand content to meet these needs is crucial for successful digital marketing.

Roche is rated as the pharmaceutical company providing the best information that can be tailored for use with patients

Managing side-effects is a well-known challenge that community oncologists face in their centers. These factors naturally work hand-in-hand, as such delivering information that addresses side-effects that can be used by community oncologists with their patients will achieve more ‘value’ for companies

Information that helps oncologists provide better patient care is the third biggest driver of satisfaction. Over three-fifths of oncologists gave Roche and Merck a Top 2 box score

It is often cited by communications experts that information that is shared endorses its value to the recipients. When assessing companies on whether their content is easy to share with colleagues

Novartis is perceived to be performing the best compared to its competitors with seven-in-10 giving Novartis a Top 2 box score

Bryter uses a range of approaches and methodologies incorporating both qualitative techniques - like digital ethnography - and advanced quantitative analysis techniques to guide and optimize channel and content strategy. Bryter’s Digital Campaign Builder is a choice-based tool that helps to truly optimize integrated channel and content preferences.

Despite the rise of digital, it is an undeniable fact that sales reps maintain their relevance today. There are an estimated 450,000 sales reps still directly employed by the industry globally, and their related activities account for 62.5 percent of all sales and marketing expenses.

As research demonstrates, there are clear opportunities for pharma companies to carve their own path in digital marketing to create meaningful engagement with audiences. As we continue to deal with the ripple effect caused by Covid-19, digital marketing will play an increasingly important role in reaching target markets. Understanding what channels to focus on, and how to pinpoint efforts to effectively reach different HCP audiences is key to strengthening these relationships.

Rather than viewing digital strategies solely as a cost-effective alternative to reps, the question needs to be: how can pharmaceutical companies take advantage of digital strategies to evolve their sales approach? Bryter provides research that can produce the insight needed to develop a comprehensive and effective digital marketing and communication strategy.

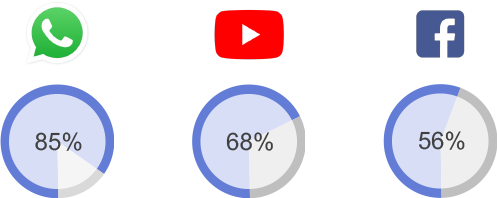

Today, the most successful reps can easily navigate digital channels such as emails, WhatsApp and Facebook to fuel relationships when a face-to-face meeting isn’t possible. The trend is to hire and train reps that can use every channel and take interactions with physicians to the next level. If used in the right way, digital solutions can keep reps connected with physicians more closely than ever.

Get in touch to see how we can help you optimize your digital strategy by understanding customer needs.

What are the points of contact here?

Unit A, 3rd Floor, Zetland House, 5-25 Scrutton Street

London

EC2A 4HJ

United Kingdom

Suites 405 & 406, 433 Broadway

New York

NY 10013

United States